Dashnor Kaloçi

Memorie.al publishes the unknown history of how the Ottoman Bank of Albania was established on February 4, 1863 and how it operated regularly until 1913 with its subsidiaries in Shkodër, Kosovo, Ioannina, Skopje and Bitola. In all its procedures, that bank operated subject to all the laws and regulations of the financial system of the Ottoman Empire, which was usually done by a supervisor appointed by the Ottoman government. The initial capital of that bank, which, as we said above, was founded in 1863, was 2,700,000 sterling, and only thirteen years after its creation, the amount of bank capital reached 5 million, which was divided into 500,000 shares. The concession period of that bank was initially set for a period of 30 years, but later it was extended two more times: once for 20 years and the second time for 12 years.

Although the creation of the National Bank of Albania dates back to October 4, 1913, (almost a year after the declaration of Albania’s independence and the creation of the government headed by Ismail Qemali), the roots of the banking system in Albania are much deeper in history. If we refer to archival documents, (which are found in the archives of Istanbul) we will see that the financial institutions in our country were created many years before the creation of the National Bank of Albania, not even a little, but a full five decades before it.

According to these archival documents and some historical studies done on Albanian finances in the years of the Zog Monarchy, where one of the most serious is considered that of Haxhi Shkoza, (former general inspector of Finances at the Zog Royal Court during the Monarchy period 1928- 1939), the operation of regular financial institutions in Albania, has its origin since 1839. But what can rightly be considered as the precursor of the National Bank of Albania, is the Ottoman Bank (at that time it was known as: Banque Ottomane ) which was created and has been functioning normally in Albania since 1863, or more precisely on February 4 of that year. So, from the financial foundations laid by that bank that had its headquarters in Istanbul, the National Bank of Albania was formed in October 1913.

Initial capital and operation of Ottoman Bank

According to various archival documents found in the archives of Istanbul, (the former capital of the Ottoman Empire) which refer to the establishment of the Ottoman Bank in Albania, starting from February 17, 1875, until February 30, 1911, that bank modified own financial concessions (shares) six times in a row. While it’s main charter, which was not changed for many years in a row, was approved in 1875. With the opening of the Ottoman Bank of Albania in that year, its main branches were also established in the four vilayet centers of that time as: Shkodër, Ioannina, Kosovo, Skopje and Bitola.

In all its procedures, that bank operated subject to all the laws and regulations of the financial system of the Ottoman Empire, which was usually done by a supervisor appointed by the Ottoman government. The initial capital of that bank, which, as we said above, was founded in 1863, was 2,700,000 pounds, and only thirteen years after its creation, the amount of bank capital reached 5 million, which was divided into 500,000 shares. The concession period of that bank was initially set for a period of 30 years, but later it was extended two more times: once for 20 years and the second time for 12 years.

Bond payments and increase in bank capital

The Ottoman Bank of Albania, according to the main laws and rules laid down in its status, on which it operated since its creation, was obliged to pay in gold coins, all the prices of the bonds that were in circulation, at the end of the concession period. Only this bank had the exclusive privilege of holding the issue of coins, which continued normally throughout its operation.

Also, this bank was obliged to have a deposit equal to one third of the amount of all banknotes in circulation. The Ottoman Bank lent against items that it would have under its control, kept bonds, trade effects, discounted financial effects, bought and sold bills of exchange, etc. Similarly, for all banking operations she performed, she received a commission at the rate of ½, up to zero percent of the amount.

Even the government was continuously credited for all its payments and remittances, which the bank made on behalf of the state. While all bank deeds were exempted from stamp duty, (on profit). In cases of dispute between the bank and various individuals, physical and legal, according to the bank regulation and also the laws in force at that time, everything was resolved in the Commercial Court, which was functioning regularly since that time.

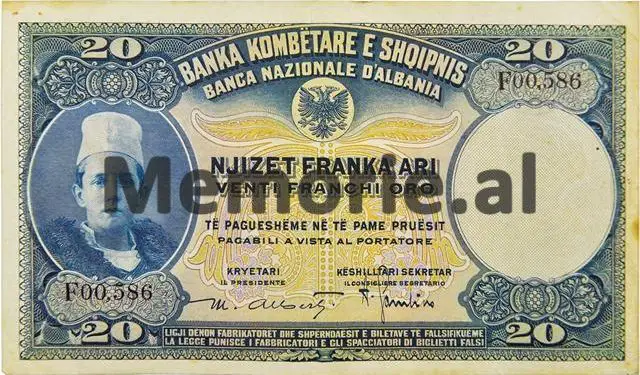

From the date of its establishment, where the Ottoman Bank of Albania had an initial banknote capital of 8,000 Turkish liras, until 1912, it managed to have in circulation a capital of 1,370,000 liras in banknotes, which it declared publicly in its balance at the end of each year. These banknotes were divided into denominations: 1, 5, 10, 20 and 50 Turkish liras. In those years (from its establishment onwards), that bank had provided the Albanian state with a loan at 6.8% and with an interest rate of 6%.

Creation of the National Bank with Italian-Austrian and Albanian capital

In 1913, (one year after the declaration of Albania’s Independence) just a few months after the secession of Albania from the Ottoman rule, such a financial institute was also created in our country under the name “National Bank of Albania”. The establishment of this bank was based on the concession dated 4.10.1913, made between the Albanian Government of that time and Mr. Baron Karol Pitner and Oskar Pollak, who were the representatives and at the same time delegates of the Wiener bank Verein based in Vienna, Austria, and Mr. Petro Fengolio and Gido Ansbacher, on behalf of Banca Commerciale Italiane based in Milan, Italy. This agreement, which led to the establishment of this bank, was made with several conditions, which were sanctioned in 23 points. It is worth publishing some of the points of that agreement, to see what were the rules on which the first bank in Albania was founded and how the banking system in our country functioned almost a century ago.

Agreement on the establishment of the National Bank

Some of the points of that agreement made in 1913, which we are giving in the original version of the written language of that time, were as follows:

- In order to create a privileged banking institute, the anonymous Albanian company, which will be named the National Bank of Albania and will have the right to bear the armorial bearings (all financial founding acts, our note) of the Albanian State.

- The location of the bank will be in the capital of Albania. It will establish as many branches and agencies as it can find in Albania and abroad.

III. The first council of administration will be marked by the two founding platoons and will remain on the job for 5-6 years. The Albanian administrators will be named with the common sense of the Albanian government and the two founding platoon…

- The Albanian government will control the issuance of bank tickets and implement exactly the orders of the statutes and regulations pertaining to the service of issuing these tickets…

V./1 Bank tickets will be issued in Albanian and French; the prices of these tickets will be determined by an administrative council in cooperation with the high commissioner of the Government.

VI./2 The bank will take care of the circulation of the State’s coins, and only it on behalf of the Government, it will have the burden of buying metals that have been scrapped (of value) to be melted down (to be melted down) again and again currencies as well as for any other currency operations.

VII. The income of the bank, shares, bonds and other titles (tahvilat) that it will issue, do not have to pay any taxes, stamps or taxes for the entire time that the bank exists. Also, the documents that the bank will issue in the dissemination of its decisions will not pay either stamps or taxes. Metals (mines, precious stones) that are cheap or few coins, drawn from the bank, will not pay anything to enter (import tax).

VIII. The government will accept and describe the final obligations (tahvilati erazi) as well as other obligations of the bank for the users of the funds (erazi) held by the State, prefectures, provinces, corporations, foundations (foundations) of all categories, as well as for the uses of having orphans. Every judicial deposit and every pledge deposit, described by the State, prefectures, provinces, corporations or foundations from all categories, to be exchanged in the bank with title and money.

- This deed of agreement, signed by His Excellency, the Prime Minister and the Council of Ministers of the Albanian State, must be submitted by the concessionaires, Banca Comercjale Italiana and Winer Bank Veren, under the rectification (verify) of their advice within three months of the administration. XVII. Dagger of the bank’s income

- This concession act – which was made in three pieces: (three copies) one remains with the Government and the other two are given to the two concessionaires – will be officially published by the Government, eight days after signing, in the known forms of the official publication of other laws (canons).

The closure of the National Bank of Albania

According to some historical sources that talk about the finances of the Albanian state, as well as those made by Haxhi Shkoza, (former inspector general of Finances at the Royal Court of Zogu), the National Bank of Albania which was founded on October 4 of the year 1913 with joint capital: Albanian-Italian-Austrian, immediately began exercising its activity by cooperating with private entities.

But unfortunately, from the years and waves of foreign invasions that passed over Albania, from the activity of that bank and its closure some time later, in the archives of the Albanian state, no act or documentation has remained and is not found. From the time of operation of that bank, only one document remains, which is a receipt issued by it, another financial institution, which the National Bank of Albania, at that time, had as a competitor.

In that document, it is written: “Syndicate for the National Bank of Albania. In receipt No. dated 6.X.1913 he received from the treasury of Finances of Vlona, grosh 545,283 (in treasury lib. 930). 257,000 grosh are withdrawn from the bank three times. It stands to receive from the bank 288,283”. This action of the financial relations of that bank turns out to be unchanged until June of 1914, and after that no other record of it has been found. Apparently, the great internal turmoil that swept Albania in 1914 (Haxhi Qamili’s Uprising), led to the closure of that financial institution, which laid the first foundations for the creation of the Albanian banking system and the National Bank of Albania itself, which would be reorganized in 1921. /Memorie.al